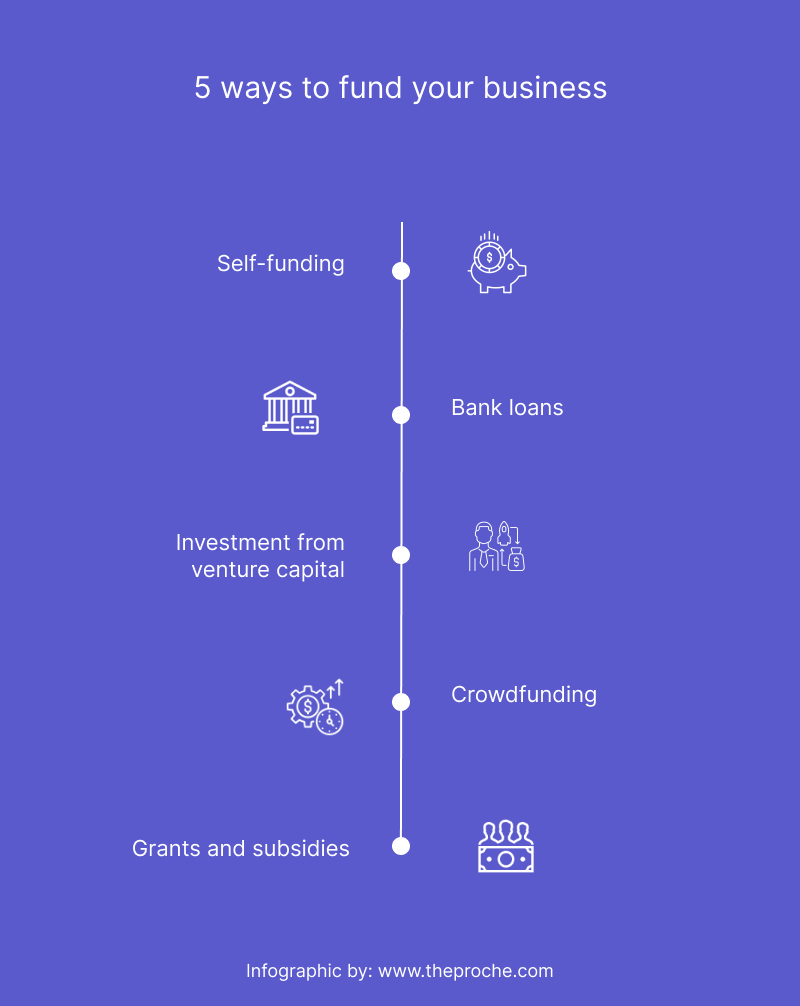

Planning to start a new business or looking forward to the business expansion? You got the idea, and now your business idea requires capital investment to kickstart. Managing funds for a business can be a challenging and tiresome task but keeping your cool and looking for the best viable solution is the key to success. I have put together five best ways to fund your business in the Czech Republic, Europe.

- Self-funding: This involves using your own savings or assets to fund your business. This can be a good option if you have a solid financial foundation and are comfortable taking on the risk of starting a business.

- Bank loans: Banks in the Czech Republic offer a range of loans for small businesses, including working capital loans and term loans. You will typically need to provide collateral and demonstrate a solid business plan in order to secure a loan.

- Investment from venture capital firms: If you have a high-growth potential business, you may be able to attract investment from venture capital firms. These firms typically invest in exchange for an equity stake in your company.

- Crowdfunding: Crowdfunding platforms allow you to raise small amounts of money from a large number of people, typically in exchange for rewards or perks. This can be a good option for businesses that have a strong online presence and a compelling story to tell.

- Grants and subsidies: The Czech government and various organizations offer grants and subsidies to support businesses in certain sectors or those that meet certain criteria. It’s worth checking to see if you may be eligible for any of these programs.

- Peer-to-peer (P2P) landing: Peer-to-peer (P2P) landing for business refers for business refers to a type of online platform that enables individuals or businesses to connect with each other directly, rather than through a central authority or intermediary. P2P platforms can be used for a variety of purposes, including buying and selling goods or services, borrowing and lending money, and sharing resources or expertise.

There are several benefits to using a P2P landing platform for business. For one, P2P platforms can provide access to a larger market of potential customers or clients, as they allow individuals and businesses to connect with each other directly. This can be especially useful for small or niche businesses that may not have the resources or reach to attract customers through more traditional channels.

In addition, P2P platforms often have lower fees or commissions compared to traditional intermediaries, which can help businesses save money and increase their profitability. P2P platforms also typically offer more flexibility and customization, allowing businesses to tailor their offerings and terms to meet the specific needs of their customers.

There are many different P2P platforms available for businesses, ranging from e-commerce sites like eBay and Etsy to lending platforms like Lending Club and Prosper. It’s important to research and compare different options to find the platform that best meets the needs of your business.

It’s important to carefully consider the pros and cons of each funding option and choose the one that is best suited to your business needs. And, If you are looking for a help with incorporating your business, opening bank account, licensing, AML consulting or any other business support, check out COREDO.