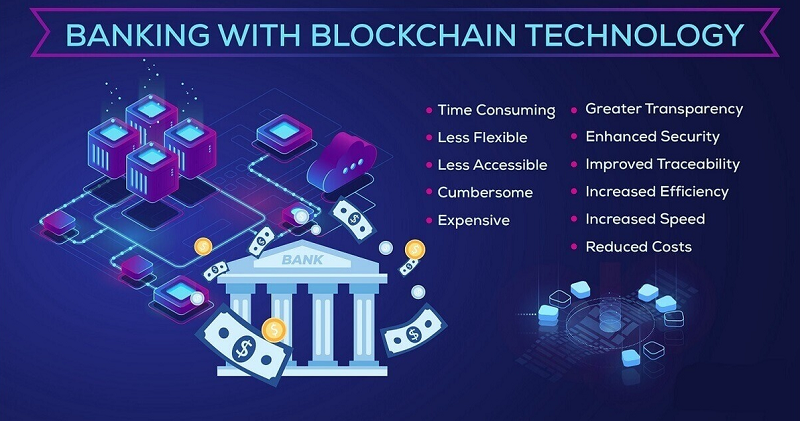

Blockchain technology has the potential to change the financial sector in the long term: Numerous business models could emerge, while many others would become superfluous. But what does this development mean for you as a bank? And how will your customers’ requirements change?

We have examined whether and how blockchain can be used to process complex transactions in the future, thanks to decentralization which increases efficiency and data security.

A blockchain is a decentralized database structure. In it, transactions are not recorded centrally on one computer but are stored and updated on many different computers – the so-called nodes. Therefore, a blockchain does not have to be managed centrally.

Transactions that are once stored in the blockchain are extremely difficult to remove again. Tampering is almost impossible. At the same time, transparency is high as almost all transactions can be tracked. A blockchain ensures high data security and speed for transactions.

Today, the blockchain is better known for being the system behind cryptocurrencies. In the future, however, all types of transactions could be processed through them.

This changes the way in which we will do business in the future because the blockchain makes it possible to replace the functions that currently require personal contact with a bank or a lawyer. This can make transactions much faster and cheaper.

The future has already begun

There is great interest in the development of blockchain technology in the banking sector. Payment transactions and securities trading can be made faster, safer and, above all, more cost-efficient. But it is still unclear whether considerable amounts of data and transactions can be stored and distributed in this way.

The business processes along the various securities transactions would have to be completely restructured and aligned. Not every company should therefore benefit from the blockchain.

In addition, blockchain is based on an open operating system. As a bank, however, you guarantee your customers the confidentiality of their data. So with the blockchain too, we have to ensure that unauthorized access by third parties is protected.

All of this requires further development, but the potential is enormous. The blockchain can make transactions safer and cheaper. We are working on making these possibilities usable for you in the future.

Permissioned blockchain for banks and insurance companies

Blockchain technology is based on the idea of abolishing central mechanisms and replacing them with decentralized structures. The concept of the Permissioned Blockchain offers enterprise users various advantages such as the control of participants and an individual authorization concept.

As a result, the Permissioned Blockchain is particularly suitable for industries with high-security requirements. It can decisively shape the future of banks and insurance companies.

The Federal Association for Information Technology, Telecommunications and New Media eV (Bitkom) came to the conclusion that blockchain technology is not yet widespread in companies. 17% of large companies with 500 or more employees used the blockchain.

For companies with 50 or more employees, it was only 2%. Compared to other industries, the banking and insurance sector tended to be open to use. However, this was only used by 6% of the companies.

The “PwC Blockchain Survey 2021” confirms a high level of interest in blockchain technology (75%) in the financial sector, but 97% of the companies do not provide a significant budget for it. The companies cite “regulatory and technological obstacles” as the reason. The framework conditions for crypto assets and digital assets have improved considerably since then. If market pressure increases in the future, this hesitation could have fatal consequences.

Permissioned blockchain as a solution for security and scalability

Permissioned blockchains are aimed at companies that formulate different requirements for a blockchain. In contrast to the public blockchain, companies, banks and the like can use the permissioned blockchain as required. The operator of the blockchain modifies the authorization concept according to the respective needs.

As a result, banks can only offer their customers access and take over the validation of the transactions themselves. The bank continues to act as the sole administrator. In addition, customers can be assigned individual authorizations.

Registration processes and identifications are an indispensable part of the permissioned blockchain and indispensable for banks. Before the bank customers transfer funds, they are clearly identified. A well-known blockchain platform that is based on the concept of permissioned blockchain is Hyperledger.

Areas of application of the permissioned blockchain

Such permissioned blockchains are always used when the demands on performance and security increase. For banks and insurance companies, the technology offers the opportunity to promote digitization -compliant and legally regulated manner and to use the advantages of decentralized blockchain technology for processing transactions.

The strict regulation is considered particularly secure compared to the public blockchain. The banks’ sensitive customer data are protected from access by third parties. The waiver of unhindered public access to the blockchain network also means greater security for customer data.

Revolutionizing the compliance environment with permissioned blockchain

Compliance management aims to ensure that companies, banks and insurance companies adhere to state rules and internal guidelines. Otherwise severe penalties are imminent. The head of the Deloitte Blockchain Institute Dirk Siegel points out that blockchain technology can provide more clarity and transparency .

The permissioned blockchain offers practical added value in reporting, for example. Banks and insurance companies are obliged to pass on certain information to the supervisory authorities. The blockchain technology stores this data in an audit-proof manner and enables complete documentation. Data manipulation is made more difficult. This makes the compliance environment in banks and insurance companies more effective. At the same time, compliance management costs fall and customer confidence increases.

Operational efficiency and process optimization in the financial sector

The use of the Permissioned Blockchain in banks and insurance companies leads to less complex processing of transactions. In the case of processes based on the division of labor, the various participants can interact simultaneously via the permissioned blockchain in order to shorten transfer times. The time-consuming sending of relevant documents is a thing of the past. Authorized participants can access the data at any time and move forward with operational business.

The optimization of processes in banking also results from the integration of smart contracts – or chain code, as it is called in the Hyperledger environment. If contractual requirements are met, the automated contract is concluded. Possible application examples are the automated payment of dividends by the banks or the smooth reimbursement in the event of an insured event.

Blockchain, a source of opportunities for banks

Blockchain or “block chain” is a technology for storing and transmitting information that aims to secure transactions. It makes it possible to keep a detailed history of interactions between users of the same service without it being able to be modified and falsified. The first application of the Blockchain remains cryptocurrency and in particular Bitcoin which has demonstrated the possibility of reducing the number of intermediaries during transactions without harming data protection.

In the French banking sector, this technology has definite potential. For example, it seems to be an effective way to improve the security and traceability of operations , to fight against fraud , to reduce costs and transaction times.while continuing the process of digitizing operations initiated several years ago. Along with these clearly identified opportunities, brakes also remain suggesting a slower generalization of Blockchain within the banking system. Among these limitations are: the need to find a consensus suitable for all actors in the ecosystem, synchronization with regulation, the technology’s approval capacity, the profitability of Blockchain infrastructures. These limits will have to be lifted in order to be able to fully exploit its potential.

The impacts of the Blockchain on the professions of the banking sector

The Blockchain is shaking up the codes of the banking sector and involves the acquisition of new skills . IT professions (administration and management of a node, carrying out transactions, storage, etc.), legal professions (changes in regulations, use of new tools and platforms based on Blockchain), compliance professions and risks are particularly affected.

Beyond traditional support functions, activities not specific to the bank are evolving. In the field of marketing, for example, the French Adschain consortium aims to fight against advertising fraud by providing a common register in which each actor in the chain enters the list of its partners. Blockchain can also be applied to the field of accounting by guaranteeing the authenticity of accounting entries thanks to the acceptance of two parties.

Thus, banking professions will have to adapt to a new ecosystem including the Blockchain. Banks have every interest in considering comprehensive support for employees in order to ensure their skills development. Specific support for businesses depending on the type of impact on their activities and skills is also necessary. Management has a key role to play in setting up these support systems.

Blockchain in finance

Applications in the finance market

We have insisted enough in the preceding presentation on the multiplicity of possible applications of the blockchain. Expect to read more and more articles, including in the non-specialist press in the near future. This is already the case in the English-speaking press.

However, it is quite obvious that in a site devoted to financing one cannot go into a little detail about the possible applications in this field.

A system making it possible to manage transactions in a secure manner, in complete confidence between the actors and with fluidity could not fail to interest the actors of the finance and this is what is happening now. We are witnessing an explosion of initiatives, most of them at the state of tests or “proof of concept” around the blockchain and distributed ledgers. Hardly a day goes by without press releases on the subject. A brief overview of the fields of application:

- The post-market securities chain: in this area, everything relies on the pivotal role of the central depository, which is the only one to keep the register of the number of securities in circulation. With the blockchain, there is no need to go through a central depository and the cascade of intermediaries who provide access to it to materialize the transfer of ownership following a purchase and sale of securities.

- The financing of international trade and trade finance. Here the complexity resides in the storage and access to commercial documents which make it possible to prove the presence of the goods in such or such port and its routing to the destination. This information could be stored in the form of “smart contracts” in a blockchain.

- The private equity financing or debt of companies: the blockchain to record and exchange business growth shares, the financing is not yet public

The banks of the future

The structural change in the banking sector is in full swing in Germany. In the course of COVID 19 measures, banks had to close branches or shorten opening times. According to the “Digital Banking Maturity Study 2020”, many banks have implemented new digital functions, such as fully digital processes for account opening (34%), remote identification & verification (23%) and contactless payments (18%).

Banks and insurance companies must orientate themselves towards the future. The Covid-19 pandemic acts as a further catalyst for digitization. A rapid conversion to digital processes has from now on top priority for many banks and insurance companies. The Permissioned Blockchain or the Open Banking concept are predestined for banking 2.0. When banks cooperate with fintech start-ups , they can get the expertise directly in-house.

It is essential for banks and insurance companies to further develop their own business model. The transformation from banks to technology and infrastructure providers offers the opportunity to remain competitive over the long term. With a holistic strategy and a focus on digital success factors, banks can form the interface to the digital economy.